Preservation & Archaeology

Grants & Incentives

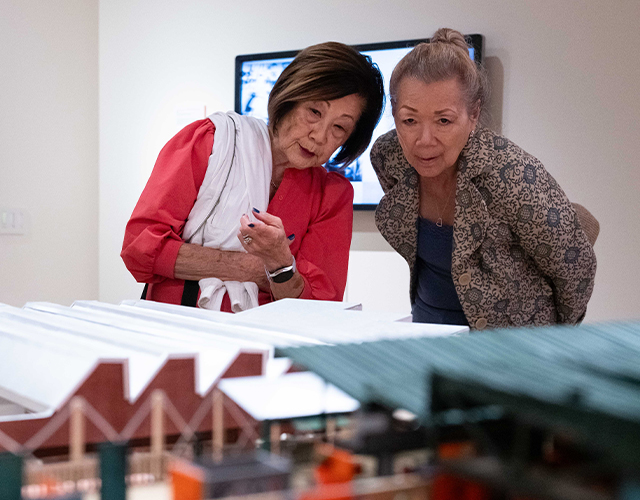

History Colorado provides grants for archaeology and historic preservation projects from two major funds.

The State Historic Preservation Office (SHPO) administers the U.S. Department of Interior's Historic Preservation Fund Program in cooperation with the U.S. Department of the Interior, National Park Service. Under this program the NPS has specified that at least ten percent (10%) of Colorado's annual program funds be subgranted to Certified Local Governments.

The State Historical Fund is a statewide grants program that was created by the 1990 constitutional amendment allowing limited gaming in the towns of Cripple Creek, Central City, and Black Hawk. The amendment directs that a portion of the gaming tax revenues be used for historic preservation throughout the state.

In addition to these grants federal and state tax laws provide tax incentives for historic preservation projects that follow the Secretary of the Interior's Standards for Rehabilitation. These credits allow taxpayers to reduce, on a dollar-for-dollar basis, the amount of income tax they owe to the government.

Certified Local Governments

The CLG Program provides a community a process to identify, preserve and promote the historic places that tell their story and celebrate their identity as a unique and exciting place to live and visit. Specific economic benefits include access to the CLG Grant Program and eligibility for State Historic Preservation Tax Credits.

Preservation Tax Credits

Learn more about the federal and state tax credit programs available for preservation projects.

Membership

Membership Donate

Donate